4 Expert Tips for Renters Looking to Buy Their First Home

Whether you’re a year or five away from getting serious about owning a place to call your own, the process of buying your first home can seem totally nebulous and daunting… one of those “I’ll figure it out when I get there” things. But the experts say that’s totally normal!

We spoke with Cori Scherer, a Houston-based mortgage expert and content creator, to dismantle some of the mystery behind this process. With almost two years of lending industry experience under her belt, Cori specializes in mortgage loan origination, helping everyone from first-time buyers to seasoned pros finance their new home. With the help of social media and her blog, she’s taken her industry know-how and found a passion for educating potential buyers on all-things financial literacy.

She shared four key tips that renters need to know as they start the journey to buy including the importance of having savings, the lowdown on down payments and closing costs, and how student loans and credit card debt can affect your ability to buy.

1 | Save. Save. Save.

This one may seem obvious, but having cash-on-hand and a healthy savings is one of the most essential factors for starting the home buying process. Buyers will first need to consider down payments and closing costs. It’s a common misconception that lenders require 20% down payments. Cori says that isn’t always the case. Down payments can range anywhere from 3-20%, depending on the type of loan and your lender. Closing costs will add an extra 2-5% into the home’s final price.

Some lenders may also look for additional reserves of cash after those expenses as a factor for approval. Essentially, lenders will look at this to assess their risk and ensure that, after your down payment and closing costs, you will still be able to pay your mortgage. In addition, homebuyers may want extra savings to prepare for moving expenses or any of those fun surprises life throws our way like repairs and maintenance.

TIP: Need help building savings? Cori offers a free downloadable budget template on her website and shares tons of money tips on her IGTV page!

2 | Assess your financial situation

In addition to having money in the bank, you’ll want to really assess your situation in-depth. Your ability to get a mortgage depends on lenders seeing a healthy financial picture, and there are a few factors they’ll look at for that.

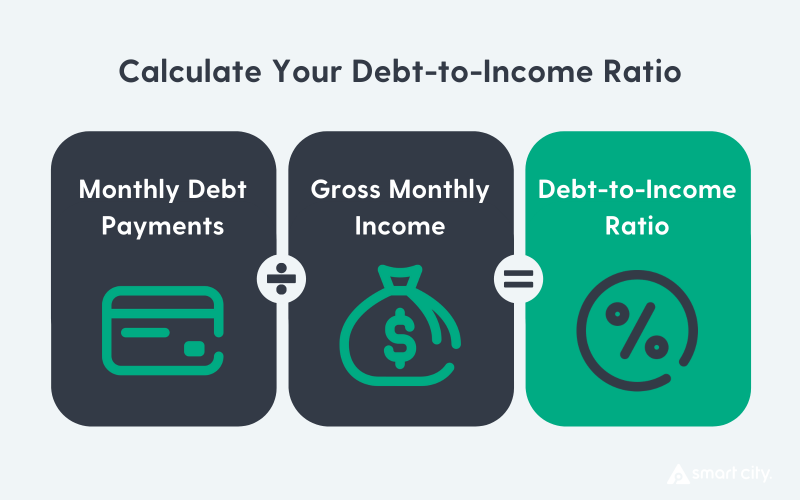

First and foremost, Cori recommends making a thorough list of your monthly expenses and revenue streams to have a solid understanding of your debt-to-income ratio. To calculate yours, you’ll want to add up all of your monthly bills (not including rent) and divide that by your gross income (or your income before taxes). In the eyes of a lender, this percentage paints a picture of your financial commitments and your ability to take on more debt. Standards vary by loan type, but lenders will generally want to see this number at about 49% or less.

Lenders will also look at factors like your income history and your credit score. These ensure confidence that you’re regularly making money and maintaining your debts. In addition to boosting this score if need be, potential homebuyers will want to actively monitor their credit score and view their report thoroughly. Be on the lookout for any irregularities that may need to be corrected or any derogatory marks.

TIP: It’s common to wonder how things like student loans or credit card debt will play into your ability to buy. Of course, every situation is different, but Cori says that generally, these things won’t necessarily be a disqualifier. Factors like debt to income ratio mean lenders are looking at your monthly payment amounts over your actual loan balances when assessing your ability to take on a mortgage.

3 | Commit to the investment

Contrary to what internet trends will tell you (we’re looking at you, Tik Tok), buying a home isn’t the right solution for everyone, and renting isn’t necessarily money lost. Buying a home is an investment, so if you’re looking to buy, you’ll want to consider your personal situation in-depth.

As a homeowner, you’re your own landlord! This is great news if you’re in the mood to paint everything pink. But it also means you’re responsible for any repairs or maintenance in the home. You’ll want to consider if this is something you’re willing and able to take on.

In addition, you’ll want to think about your personal situation and the outlook for moving in the foreseeable future. Maybe you plan to move to a new city in a few years. Or maybe you’ll want to settle in for the long haul and view the home as a long-term investment. Of course, everyone’s situation is different and life happens, but Cori says a good rule of thumb is to mentally commit to ownership for at least two years to see a return on your investment (and tbh, effort).

4 | Decide what you’re looking for

Okay, so let’s recap. You’ve assessed your finances and know you can buy, and you’ve assessed your personal situation and you’ve decided you want to buy. Now, it’s time for the fun part- deciding on what you want to buy. Like we said before, homeownership is an investment and a major part of your life, so you will want to put a lot of thought into this one. Start by thinking about your wants and needs, considering what’s important to you. This could be general guidelines like size, finishes, or neighborhood, or specifics like walkability, school districts, or your commute. Also, consider if you’re looking for something move-in-ready or if you’re willing to do some fixing up.

Our followers will be familiar with the apartment triangle. In a world where you usually can’t have it all, this matrix helps renters determine which factors are most important in their ideal apartment. The same basic principles will apply to your home search. Cori suggests that, while this may be complicated, trusted professionals (like your Realtor) can give expert advice and help meet your specific needs.

See? It’s not that scary. Overall, the biggest takeaways from our chat with Cori were the importance of preparedness and having a firm grasp on your situation. There are tons of options and countless scenarios that someone looking to buy a home may encounter, but with a little know-how and the help of trusted experts during the process, we know you can do it.

Cori Scherer is a Houston-based mortgage expert and content creator. Follow her on Instagram or check out her website for more tips, or to get connected with her services.